In a recent investigative report, RTV has brought to light a troubling scandal involving Euro Exim Bank Ltd and its dubious issuance of bank guarantees. The revelations paint a concerning picture of financial mismanagement and potential fraud, shedding light on the discrepancies in bank guarantees issued and the questionable practices of financial institutions involved.

The Heart of the Scandal

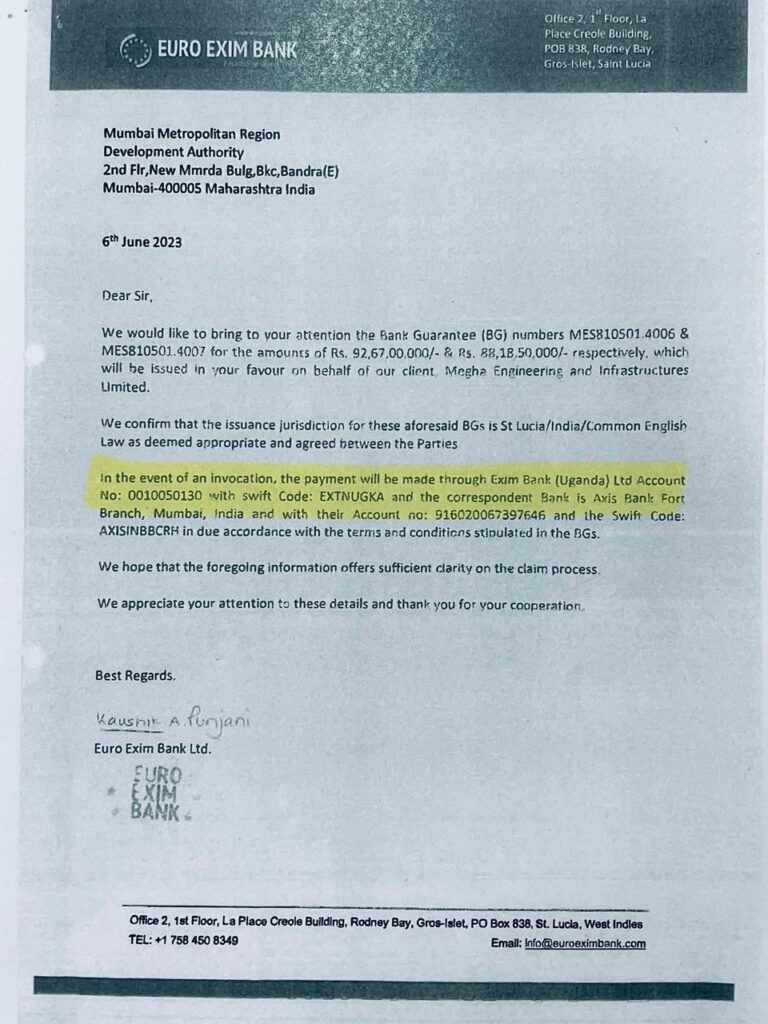

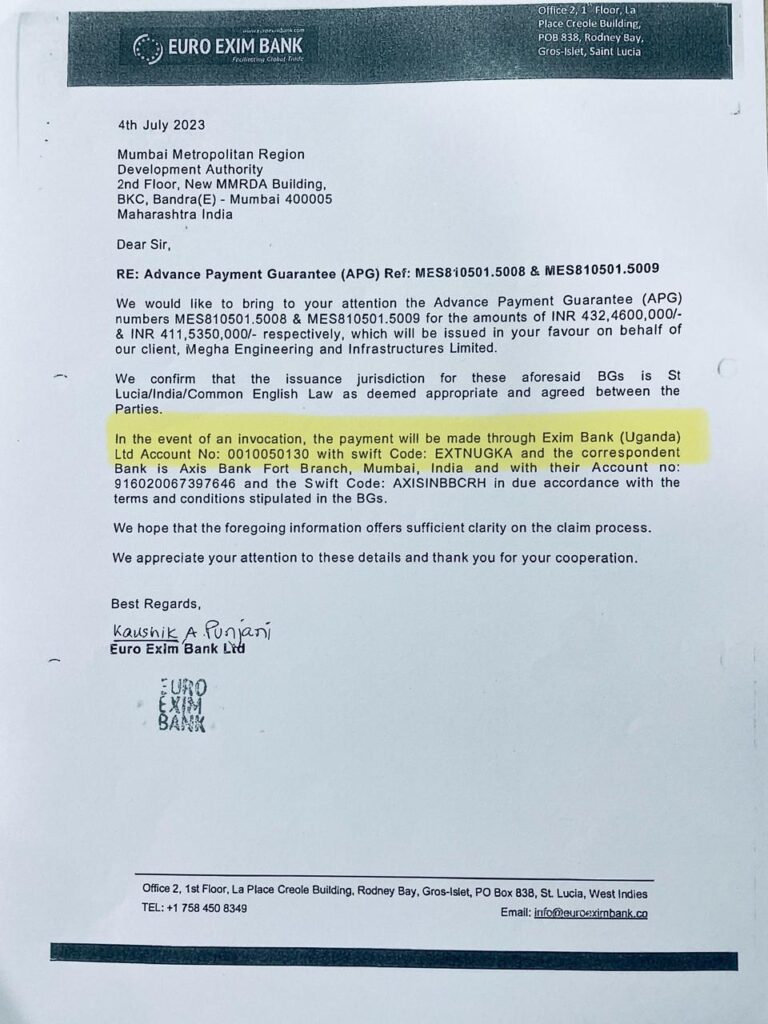

At the center of this controversy are letters issued by Euro Exim Bank Ltd to Megha Engineering & Infrastructures Ltd (MEIL). RTV has uncovered two critical documents from this exchange:

- Letter Dated June 6, 2023: Similarly, this letter reiterated that payments for the bank guarantee, if invoked, would be routed through Uganda Exim Bank.

2. Letter Dated July 4, 2023: This letter assured MEIL that in the event of an invocation of the bank guarantee, payments would be processed through Uganda Exim Bank.

Both letters are identical in their terms, raising questions about the legitimacy of the guarantees provided by Euro Exim Bank Ltd.

Discrepancies in Financial Standing

The core issue arises from the financial standing of the institutions involved. Euro Exim Bank Ltd, according to the documents reviewed, has issued bank guarantees totaling $123 million. However, Uganda Exim Bank, which is supposed to handle these payments, reportedly has a net worth of only $90 million. This discrepancy highlights a significant issue: how can a bank with fewer assets support guarantees that exceed its financial capacity by $33 million?

Complex Financial Routing

Adding to the complexity, RTV’s investigation reveals a convoluted financial routing process:

- Euro Exim Bank Ltd issues the guarantees.

- Exim Bank Uganda is involved in the transaction.

- Exim Bank Tanzania and Mauritius Commercial Bank are intermediaries.

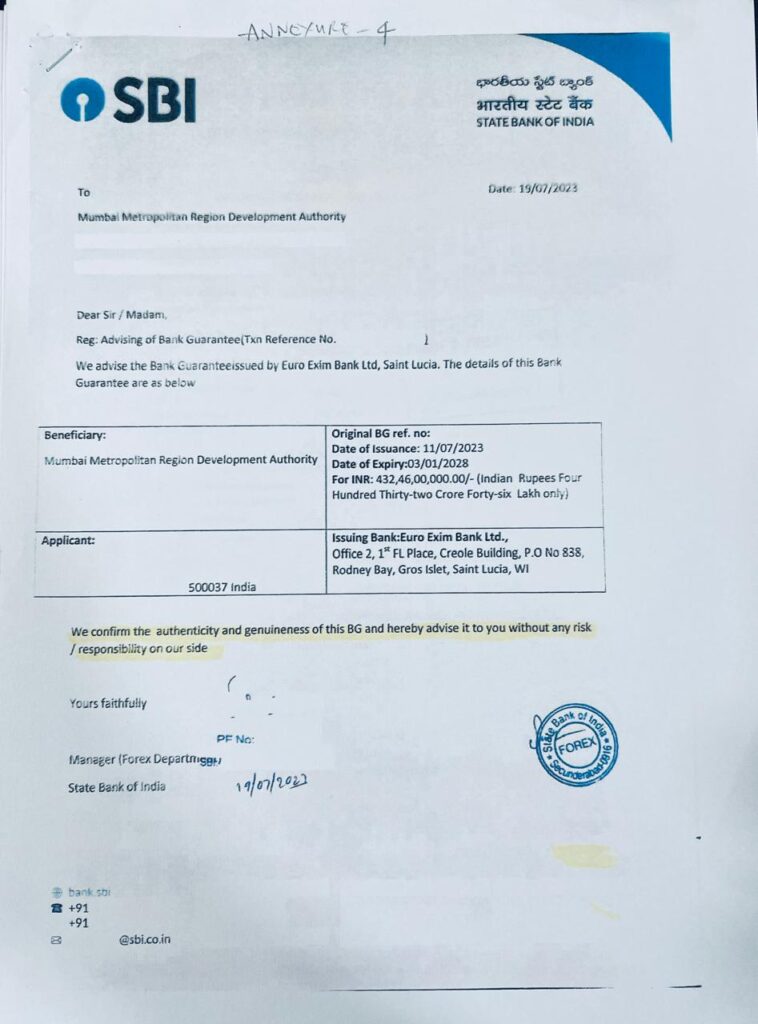

- Finally, the transaction reaches State Bank of India (SBI).

The routing through multiple banks, including private entities like Exim Bank Uganda and Exim Bank Tanzania (which are not government institutions despite their names), raises questions about the authenticity and reliability of the guarantees.

The Role of SBI

One of the most critical aspects of this scandal is the involvement of the State Bank of India (SBI). SBI’s letter states, “We confirm the authenticity and genuineness of this BG and hereby advise to you without any risk/responsibility on our side.” This statement raises serious concerns about the extent of due diligence SBI undertook to verify the legitimacy of Euro Exim Bank Ltd’s bank guarantees. The lack of clarity on the level of scrutiny applied casts doubt on how effectively SBI validated these guarantees and whether proper verification procedures were followed.

A Call for Investigation

The revelations by RTV highlight an urgent need for a thorough investigation into the practices of Euro Exim Bank Ltd and the financial routing processes involving multiple banks. It is crucial to address how such large discrepancies in bank guarantees went undetected and to hold accountable all parties involved in this potential financial mismanagement.

As the investigation unfolds, it will be essential to understand the broader implications of these findings on the financial industry and the integrity of international banking transactions. The case underscores the importance of stringent checks and balances in financial operations to prevent similar scandals in the future.

Stay tuned as RTV continues to dig deeper into this developing story, uncovering more details and seeking answers to the pressing questions surrounding this financial scandal.