- Defamatory Statements: RTV Telugu accused Euro Exim Bank of fraud and issuing fake

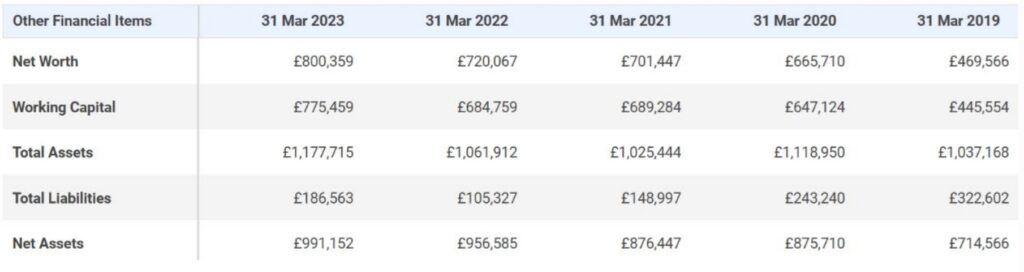

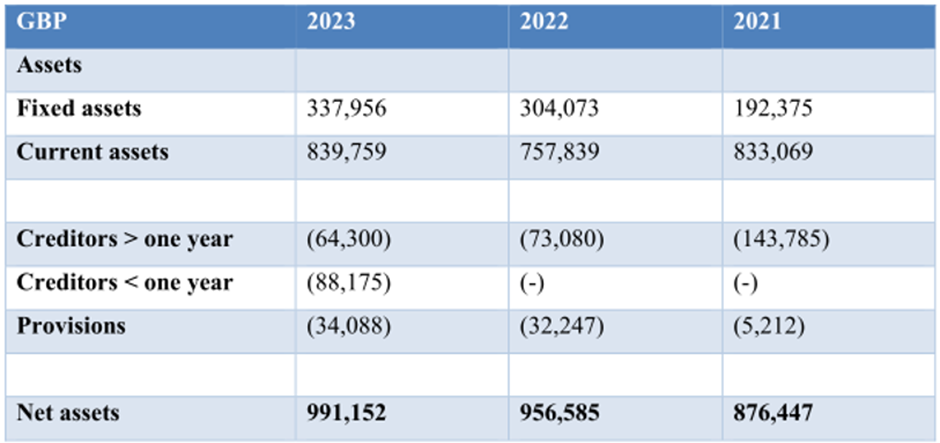

bank guarantees. - Financial Status Misrepresentation: RTV Telugu misrepresented the bank’s net worth as INR

8 crore; actual net worth exceeds INR 1900 crore as per financial records for the fiscal year

2023-24. - Accusations of Illicit Fee Collection: RTV Telugu implied the bank collected fees through

illicit methods like ‘hawala’, however, the bank clarifies fees are collected legally. - Demands: EEB demands a public apology, removal of defamatory content within 15 days, or

faces a defamation lawsuit seeking INR 100 crore in damages.

128https://medianoise.in/euro-exim-bank-issues-legal-notice-to-rtv-telugu-over-defamatory-broadcast-seeks-apology-rs 100-crore-in-damages/, https://sarkarihelpline.com/euro-exim-bank-files-one-hundred-crore-defamation-lawsuit-against rtv/

61

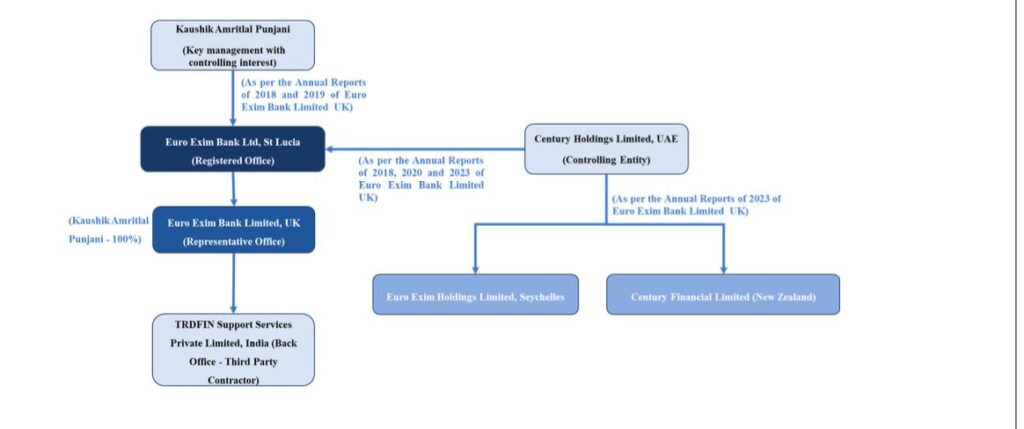

Critical pointers noted during Ripple signing up with EEB

As per article dated January 29, 2019, the following were mentioned about EEB: - EEB is an offshore bank registered in a tax haven, not a London-based bank, despite its

registered London office operating as a small company in the UK. - Additionally, the bank’s website explicitly states that it does not offer services to individuals or

entities in Saint Lucia, indicating that Euro Exim Bank should not be considered a bank based

in Saint Lucia. - EEB’s registration with the U.K.’s Financial Conduct Authority (FCA) was terminated in

February 2017, according to information on the FCA website. As a result, the bank is currently

not authorized to offer regulated financial products and services in the U.K. - EEB does not hold a banking license in any country within the European Economic Area

(EEA), which includes the EU member states, Norway, Iceland, and Liechtenstein. While it

may be regulated by authorities in Saint Lucia, this regulation does not extend to making it a

licensed bank in the U.K. or Europe. In order to operate an onshore banking business in the

U.K. and access the broader EU market, banks must be licensed by the U.K. regulatory

authorities. - EEB lacks an onshore banking license anywhere in the world. EEB as an offshore entity, cannot

access central bank liquidity or conduct direct currency settlements. - The bank relies on correspondent banks for fund clearing, which can delay transactions and

expose it to risks such as intermediary bank failures (Herstatt risk) and compliance challenges

related to money laundering and sanctions.

Posting on X (Twitter) - A post dated July 14, 2024, mentioned that EEB is a financial institution and not a bank. The

company is worth INR 8 crores, however, gave guarantee for 31 projects worth INR 480 crores.

It was also alleged the Jagan Mohan Reddy who is a Member of Legislative Assembly is behind