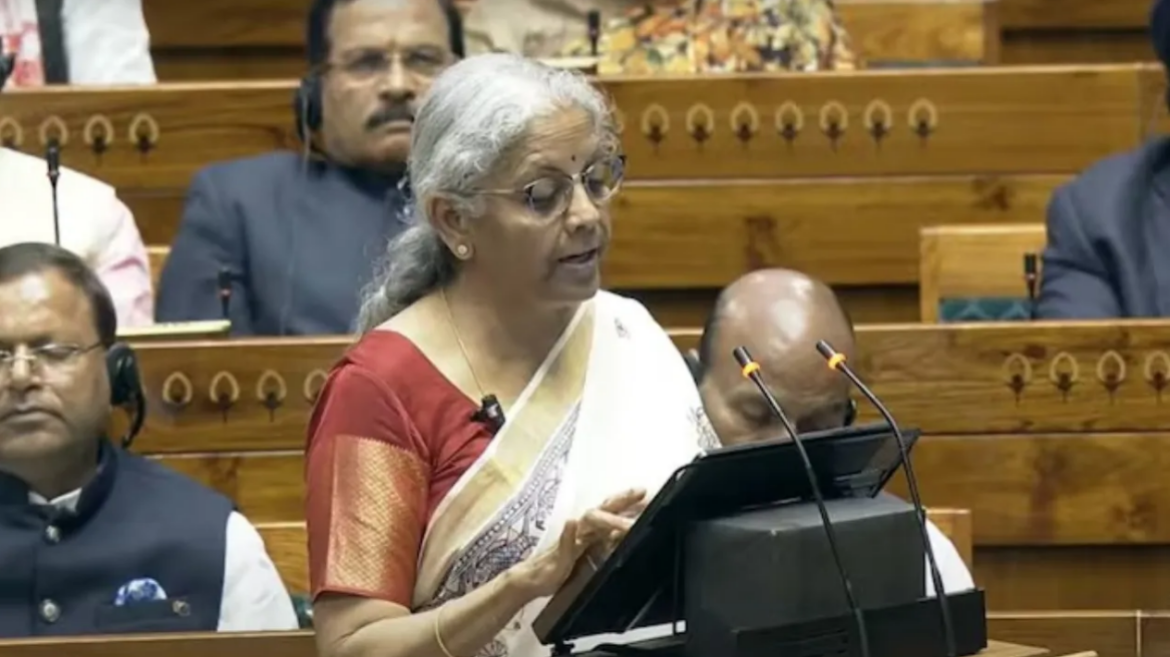

Union Finance Minister Nirmala Sitharaman has clarified that individuals earning an annual income of up to Rs 12 lakh will be exempt from paying taxes. The newly announced tax slabs include a 0% tax rate for those with an annual income ranging from Rs 0 to Rs 4 lakh, and a 5% tax rate for those earning between Rs 4 lakh and Rs 8 lakh.

However, confusion has arisen regarding the application of these rates. In practice, individuals with an income exceeding Rs 12 lakh will have their earnings divided into specified slabs for tax calculation. For example, if an individual’s income is Rs 20 lakh, after a standard deduction of Rs 75,000, the taxable income will be Rs 19.25 lakh. The tax slabs are as follows:

– Rs 0 – Rs 4 lakh: 0% tax

– Rs 4 – Rs 8 lakh: 5% tax

– Rs 8 – Rs 12 lakh: 10% tax

– Rs 12 – Rs 16 lakh: 15% tax

– Rs 16 – Rs 20 lakh: 20% tax

– Rs 20 – Rs 24 lakh: 25% tax

– Above Rs 24 lakh: 30% tax

The new tax scheme offers savings of up to Rs 80,000 for those earning up to Rs 12 lakh annually. Previously, individuals earning over Rs 15 lakh were taxed at 30%. Under the revised structure, the 30% tax will now apply only to incomes exceeding Rs 24 lakh, with new slabs introduced for the Rs 16-20 lakh and Rs 24 lakh and above income brackets.

ALSO READ: Gold and Silver Prices Soar to Record Highs Amid Weakening Rupee