RTV has uncovered a colossal financial scam, exposing fraudulent activities worth thousands of crores. The investigation has highlighted that the thousands of crore exposed is merely a fraction of a larger, undisclosed scam. The deception revolves around fake bank guarantees purportedly issued by MEGHA Engineering Company.

In our country, some individuals are amassing fortunes worth thousands of crores of rupees at the expense of ordinary citizens. Consider how many guarantees banks demand when a common person applies for a home loan. Reflect on the numerous hoops one must jump through to secure a simple loan. These instances are not isolated incidents—imagine the vast sums of money these bankers silently accumulate. Let’s delve deeper into the banking scandals, echoing beyond the 1992 Harshad Mehta scam.

In this scam narrative, three main players emerge:

- Euro Exim Bank takes the first role, positioned as a pivotal entity.

- Infrastructure companies such as Megha Engineering and Infra Limited (MEIL) assume the second role.

- The third role is occupied by India’s two largest banks, State Bank of India (SBI) and Union Bank of India.

Let’s delve into the specifics of Euro Exim Bank. While the name might suggest it’s a major European bank, its significance in Europe is limited. The foundation of this scam lies in Euro Exim’s operations. Located 13,500 kilometres away from India, in the small country of St. Lucia, nestled between North and South America, this bank operates. St. Lucia, with a population of merely 200,000, is part of the West Indies. Recently, Team India clinched the T20 World Cup in the neighbouring country of Barbados, and St. Lucia is situated nearby. You might question what relevance the Euro Exim Bank holds for India. Simply put, this bank issues substantial guarantees for large-scale projects within India.

What exactly is a bank guarantee?

It’s a form of security submitted by a contractor to ensure performance. Typically, the bank guarantees around 10% of the project’s total cost. This is precisely what Euro Exim Bank facilitates. However, there are three startling aspects you should be aware of:

Shock Number 1: Euro Exim Bank is not actually a bank but rather a financial company.

Shock Number 2: It’s not listed among the banks recognized by the RBI (Reserve Bank of India).

Shock Number 3: Despite being headquartered in St. Lucia, the company operates under the legal jurisdiction of England and Wales.

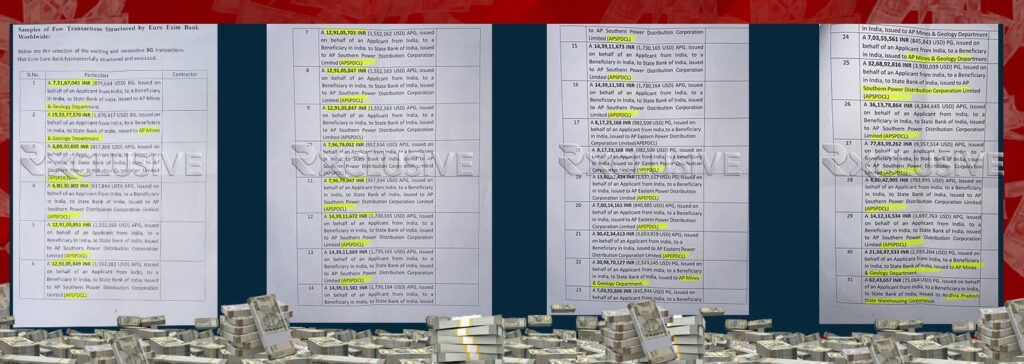

The Euro Exim Bank has a total value of only 800,000 pounds, which translates to approximately Rs 8 crores in Indian currency. Despite this relatively modest value, the bank has issued guarantees amounting to Rs. 481 crore for 31 projects in Andhra Pradesh alone. RTV has documented evidence and a list detailing these projects. Considering that the bank’s net worth is merely Rs. 8 crore, the issuance of guarantees totaling Rs. 481 crore raises significant concerns about the scale of fraudulent bank guarantees in Andhra Pradesh.

Vijayanand, Santhosh Rao, and Padma Janardhan Reddy from the power department have approved these fake bank guarantees. Additionally, companies linked to Telangana minister Ponguleti were involved in submitting fraudulent bank guarantees in Andhra Pradesh. The Andhra Pradesh Mines and Geology Department also endorsed these illicit guarantees. Karnataka’s discoms similarly accepted these fraudulent bank guarantees. Significant government projects managed by agencies like MMRDA in Maharashtra have become embroiled in this scam through these deceptive guarantees.

Megha Engineering firm has notably profited from these fraudulent activities. Shockingly, the company issued a bank guarantee of Rs. 432 crore to Megha Engineering Infra Limited for the construction of a tunnel from Thane to Borivali as part of the MMRDA project in Maharashtra. It’s crucial to note that this guarantee amounts to 10% of the total project cost, which indicates that the project itself is valued at Rs. 4,320 crore. This illicit use of bank guarantees has allowed thousands of crores to flow into their accounts.

Further revelations will uncover more startling aspects of who benefits and how in this entire guarantee scam. According to regulations, the financial stability of the company issuing the guarantee must be scrutinized to ensure its capability to fulfill the guaranteed amount. However, such due diligence is conspicuously absent in this scam. Bank guarantees are typically issued based on the documented financial strength of the company. In this case, Euro Exim Bank, acting as the guarantor, charges a commission of 3% to 4%. It’s important to note that no legitimate bank is authorized to levy such commissions. This raises suspicion that illicit funds, possibly involving black money, are facilitating these transactions through informal channels like hawala, though no concrete evidence has surfaced yet.

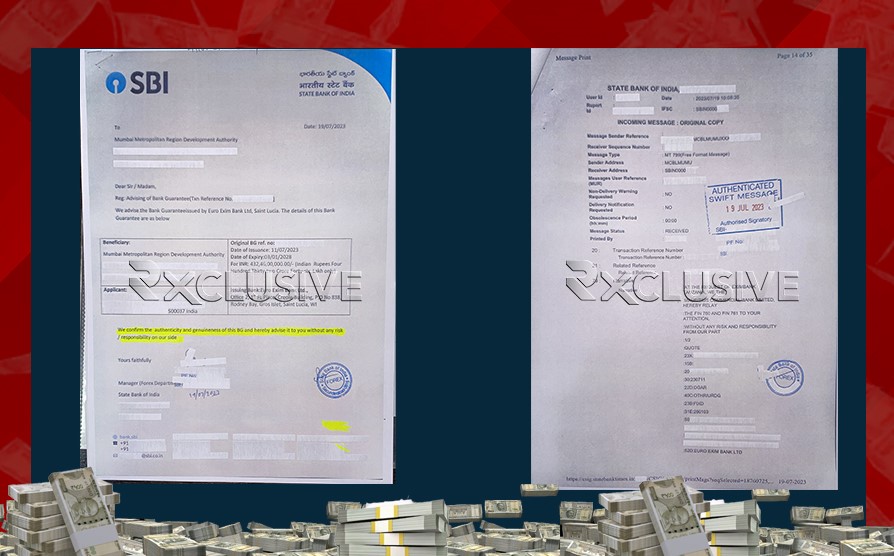

The involvement of the two largest banks in India, namely the State Bank of India (SBI) and Union Bank of India (UBI), is pivotal in this elaborate scam. RTV has obtained evidence illustrating how Euro Exim Bank has established a direct line with these Indian banks. Both SBI and UBI have issued a letter stating, “We acknowledge Euro Exim Bank’s guarantee as standard practice, but we bear no responsibility for it.” Essentially, this statement implies that while SBI and UBI acknowledge the validity of Euro Exim Bank’s guarantees, they are not liable for them.

You might question the credibility of these claims. Senior journalist Poonam Aggarwal investigated and questioned the Euro Exim Bank employee Chaitanya over a phone call, where he divulged comprehensive details shedding light on this matter.

Poonam Aggarwal: Hello, am I speaking with Chaitanya? My name is Anamika, calling from [Company]. Is this a good time to speak with you? Do you work at Euro Exim Bank?

Chaitanya: Yes, this is Chaitanya.

Poonam Aggarwal: Our company is seeking a bank guarantee. Is Euro Exim Bank located in St. Lucia? Are there any branches in Delhi or elsewhere in India?

Chaitanya: Euro Exim Bank operates exclusively from St. Lucia and does not have branches in India. Guarantees are issued in collaboration with banks like SBI and Bank of Maharashtra.

Poonam Aggarwal: So, if we obtain a letter from a nationalized bank, you would provide a guarantee?

Chaitanya: Yes, we have issued bank guarantees ranging from 350 to 400 in India.

Poonam Aggarwal: Is this practice legally permissible?

Chaitanya: No, it requires careful consideration.

Poonam Aggarwal: Since when has Euro Exim Bank been operational?

Chaitanya: We have been operational since 2018, providing guarantees for state and central government projects such as NHAI, MMRDA, KPCL, Tamil Nadu Water and Drainage, Karnataka Rural Water Supply, and to companies including Mega Engineering in Hyderabad.

Poonam Aggarwal: Can you disclose specific projects that were guaranteed?

Chaitanya: I’m unable to disclose that information.

Poonam Aggarwal: Are you residing in Delhi?

Chaitanya: No, I’m based in Hyderabad.

Poonam Aggarwal: Can you share any documentation regarding these guarantees?

Chaitanya: I will send the relevant documents to you.

SBI, UBI, and Euro Exim Bank are also found to be in breach of RBI regulations. According to RBI guidelines, the bank issuing a guarantee to a beneficiary must bear sole responsibility. For instance, when the government is the beneficiary of a bank guarantee in public projects, it should rightfully receive the guaranteed amount. However, loopholes are exploited to circumvent this obligation. Often, just before a guarantee expires, legal cases are strategically initiated and prolonged, exploiting a rule that exempts payment of bank guarantees during legal disputes.

In the guise of a foreign entity, the government is being openly deceived, blatantly disregarding regulations. Such a massive fraud cannot be executed by just one or two individuals; it necessitates a sprawling network. Certain individuals are jeopardizing the nation’s revenue by exploiting systemic weaknesses. These large corporations undertake projects crucial to our infrastructure—roads, bridges, dams, tunnels—all funded by taxpayer money. They manipulate loopholes to siphon off these funds for personal gain.

In China, those found guilty of such fraud are sentenced to death multiple times over. However, in our country, these companies manage to evade punishment by offering hefty bribes to officials and politicians. How can a company with a mere Rs. 8 crore valuation issue bank guarantees worth thousands of crores in India? The RBI must take decisive action against this scam. It is crucial to impart a stern lesson to those who misuse the taxes paid by the people.