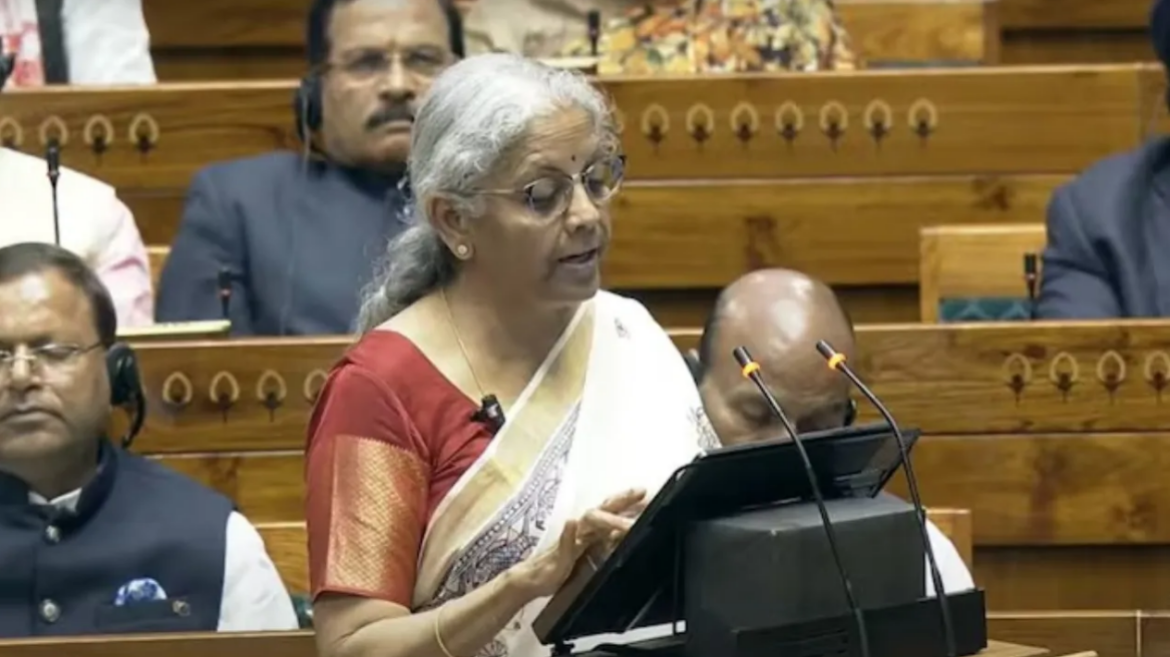

Union Finance Minister Nirmala Sitharaman presented the Union Budget for 2025-2026, making significant provisions aimed at benefiting various sectors, including middle-class taxpayers, agriculture, healthcare, and small businesses. Here are the key highlights of the budget:

– Income Tax Relief for Middle-Class Employees:

– Income up to ₹12 lakh will be tax-free.

– A 15% tax rate will apply on earnings between Rs 12 lakh and Rs 16 lakh.

– A 20% tax rate will be applied on earnings between Rs 20 lakh and Rs 24 lakh.

– Earnings above Rs 24 lakh will be taxed at 30%.

– Affordability Measures for Consumers:

– Several essential goods, including mobile phones, TVs, and electric vehicles, are set to become more affordable, as the government has removed the cess on 82 items.

READ MORE: Finance Minister Nirmala Sitharaman Allocates Significant Funds for Andhra Pradesh in Union Budget

– New Tax and Healthcare Initiatives:

– A new income tax bill will be introduced in the coming week.

– 36 cancer medications will be available at lower prices.

– Health insurance coverage will be extended to gig workers.

– Infrastructure and Senior Citizens Support:

– The government will launch a new “UDAN” scheme to provide services to an additional 4 crore passengers.

– The TDS limit for senior citizens has been increased from Rs 50,000 to Rs 1 lakh.

ALSO READ: AP CM Chandrababu Welcomes Union Budget 2025

– Agriculture and Tax Filing Provisions:

– The income tax filing deadline has been extended from 2 years to 4 years.

– The government will focus on increasing the production of pulses, such as lentils and tur dal, over the next six years.

– The Kisan Credit Card loan limit will be increased from Rs 3 lakh to Rs 5 lakh.

– Support for Small Businesses and Farmers:

– A new Makhan Board will be established in Bihar, aimed at benefitting small farmers and traders.

– Special credit cards for small industries, with 10 lakh cards to be issued in the first year.

– The MSME loan guarantee cover will be raised from Rs 5 crore to Rs 10 crore, with Rs 1.5 lakh crore in loans available.

– Startup loan limits will increase from Rs 10 crore to Rs 20 crore, along with a reduction in guarantee fees.

These measures are designed to provide substantial relief to taxpayers, enhance infrastructure, and support economic growth in critical sectors.